22 August 2017

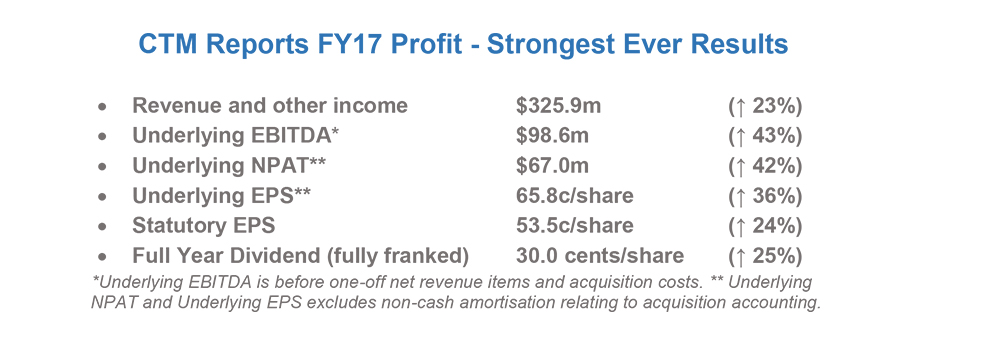

CTM Reports FY17 Profit - Strongest Ever Results

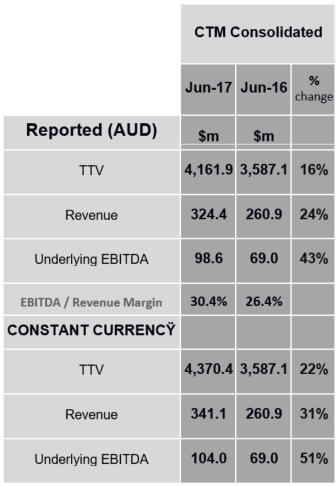

Corporate Travel Management (CTM, ASX: CTD) has today reported its strongest ever full-year results, with underlying EBITDA of $98.6 million reflecting a 43 per cent increase on the previous year (constant currency# equivalent: underlying EBITDA of $104 million reflecting 51 per cent increase).

CTM Managing Director and founder Jamie Pherous said CTM had continued to expand, with organic growth contributing to $16 million of its profit growth.

“We have delivered another great result despite challenges in the global economy. Each region in our network grew significantly above market, demonstrating that our business model and strategic investment decisions are working well for our clients and investors’, Mr Pherous said.

“CTM’s global operations have continued to grow, with revenue up 24 per cent (or 31 per cent on a constant currency basis) due to high client retention and significant new client wins, a strong technology infrastructure and the successful integration of businesses, increasing market scale,” he said.

CTM’s founding regions, Australia and New Zealand, reported a 28 per cent increase in underlying EBITDA to $36.3 million, resulting from a highly optimized business model and an impressive 80% uptake in CTM’s technology solutions by customers.

“Our top performing region, by growth percentage, was Europe, with an underlying EBITDA of $18.4 million up 202 per cent, which is equivalent to 259 per cent on a constant currency basis.”

Despite uncertainty regarding US tax and infrastructure initiatives, CTM’s North American business proved to be a top contributor in both revenue and profit.

With an underlying EBITDA of $35.9 million, up 69 per cent (75 per cent on a constant currency basis), CTM’s North American business was only marginally behind Australia and New Zealand as its largest profit contributor, which recorded an underlying EBITDA of $36.3 million, up 28 per cent.

CTM reported to be winning significant global clients off the back of its increased global presence and award-winning SMART Technology offering, now establish in all regions and with a large flow of developments scheduled for FY18.

Mr Pherous noted that CTM’s record results reflected the continued success of its business model, with underlying earnings per share growing 36 per cent (excluding amortisation from acquisition accounting), to 65.8 cents.

Mr Pherous said that, with CTM’s global footprint now firmly in place, the business would continue to focus on its core initiatives moving into FY18.

“Looking forward, we will continue to successfully execute CTM’s value proposition in every global market; delivering customer service excellence and industry-leading technology solutions that demonstrate a return on investment”, he said.

CTM expects full-year underlying EBITDA for FY18 to be in the range of $120-125 million, representing 22-27.5 per cent growth on this financial year.

The CTM Board has declared a final, fully-franked dividend of 18 cents per share, to be paid on 5 October 2017.

#Constant currency reflects June 2016 as previously reported. June 2017 represents local currency converted at FY2016 average foreign currency rates.

About Corporate Travel Management – click here