26 February 2016

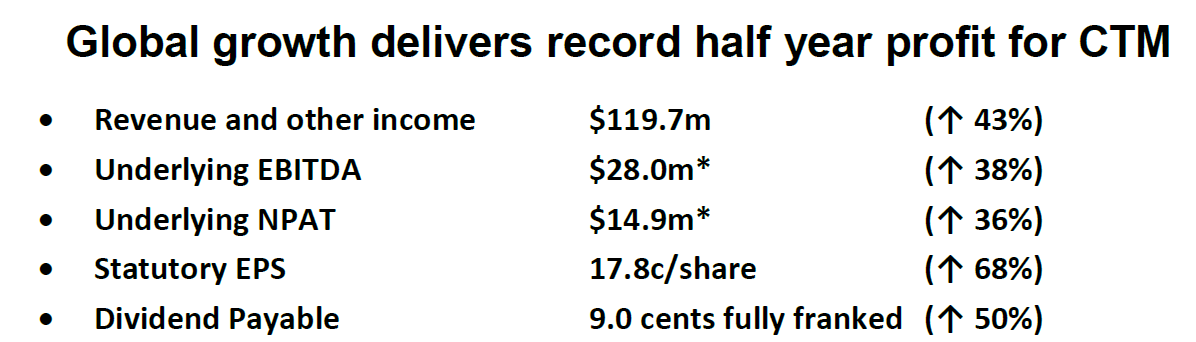

Global growth delivers record half year profit for CTM

* Underling EBITDA and NPAT is before one-off net revenue items after tax of $2.4m, being acquisition costs of $0.1m and earn-out consideration write-back of $2.5m. Statutory EBITDA $30.4m

Corporate Travel Management (CTM, ASX Code: CTD) today reported record half-year profits, buoyed by organic growth in each of its domestic and international markets.

CTM’s global operations managed more than $1.7 billion in travel transactions in the past six months, a 54 per cent increase on last year’s equivalent result.

The increase was largely driven by organic growth, with 73 per cent of the $656 million lift in total transaction value coming from new client wins.

Organic growth also accounted for 54 per cent of CTM’s revenue growth and 80 per cent of underlying EBITDA growth for the half year.

In announcing the results, CTM reaffirmed its full-year profit result was expected to be approximately $68 million, at the top of previous guidance.

CTM Managing Director and founder Jamie Pherous said the results demonstrated the strength of CTM’s business model in the face of challenging business conditions in Australia and overseas.

Mr Pherous said the company was well positioned, with cash generation at record levels across all of CTM’s operations.

“Our continued strong performance is a direct result of executing the clear strategic plan we have laid out,” Mr Pherous said.

“We have been clear our focus is on building a sensible global footprint that would become our growth platform to build market share through; winning and retaining clients; innovating customer-facing technology; focusing on internal automation; leveraging scale; and, ensuring our staff are empowered to best service our clients.

“Today’s results emphasise this strategy is delivering on all fronts.”

Central to the company’s performance, Mr Pherous said, were the benefits that resulted from the company’s investment in its own technology that simplified every stage of the customer experience.

“Our client-facing technology has been a contributing factor in winning market share. We continue to roll this out globally for the benefit of our clients both locally and globally.

In Australia, CTM won a record value of new clients in the past six months, delivering 12 per cent EBITDA growth and record EBITDA margins despite client-specific slowdowns in the resources sector. This is attributable to internal innovation and automation to service CTM’s clients more effectively.

In Asia, CTM delivered a 67 per cent growth in EBITDA, on 33 per cent revenue growth.

“This demonstrates the upsides we believe we can achieve in North America and Europe, as these markets mature over time they can enjoy the benefits that come with scale by applying the CTM business acumen, particularly around winning market share,” Mr Pherous said.

The company’s European operations have delivered 29 per cent growth in transactional value, and were expected to deliver an even stronger performance in the second half.

Mr Pherous said CTM was involved in a number of multi-regional tenders that were only possible because of the company’s global network.

“Europe has been instrumental in delivering new business, in order to meet clients’ expectations of a global service provider,” Mr Pherous said.

“Our focus in Europe is building a sustainable organisational structure for the long term, while delivering productivity gains through more automation.”

In the North American market, CTM’s TTV increased 20 per cent, including 7.5 per cent organic growth.

Montrose Travel, acquired on 01 January 2016, did not contribute to the first half results but was expected to contribute AU$4 million to EBITDA in the second half.

“I am proud of the performance that has delivered these results, including continued high client satisfaction and staff engagement rates,” Mr Pherous said.

“We will continue to invest in technology, including developing our client-facing SMART Technology suite, to deliver the best experience for our clients and a stronger result for our business.”

The CTM Board has declared an interim, fully franked dividend of 9.0 cents per share, to be paid on April 8, 2016.

About Corporate Travel Management – click here